Letocredit loans in South Africa in January 2026 🇿🇦

This page is a complete review of Letocredit loans in South Africa in 2026, explaining how the Letocredit online loan process works, who it suits, and what to keep in mind. On Lafingo you can compare Letocredit with other South African online loans, check sums, terms and reviews in one place, and choose the most suitable offer for your budget. Lafingo gives you a convenient, transparent comparison service so you see interest, fees and repayment terms clearly before you apply.

💰 Apply for a Letocredit loan now, get matched with fast online offers in rand and cover your urgent expenses with a simple digital process, then repay in manageable instalments.

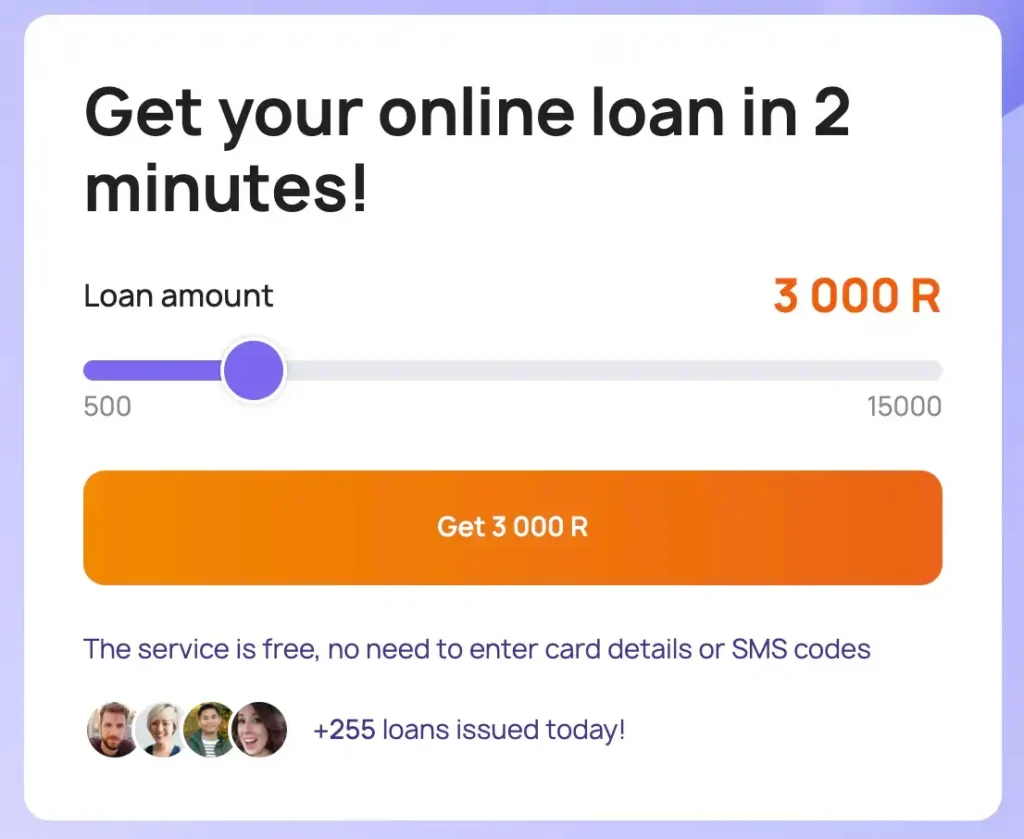

Get 500 – 15 000 R

Letocredit is positioned as a free online loan aggregation service that helps South Africans find quick, secure micro loans with low rates and special offers for new clients. The platform does not issue loans itself, but connects you with registered lenders that process your Letocredit loan online application directly on their side. Thanks to its fast process, minimal personal data requirements and support for borrowers without a traditional credit score, Letocredit has become a popular entry point for quick loans in rand.

What is a Letocredit loan? 💳

Letocredit is an online loan comparison and referral platform in South Africa that helps users find and apply for short term and personal loans completely online. Instead of acting as a bank or micro lender, Letocredit gathers offers from multiple partners, allowing you to choose a Letocredit online loan that matches your needed amount and repayment period.

With Letocredit, you can apply for different online loan products, such as quick loans for emergencies, small personal loans and flexible short term credit facilities. The service emphasises low and favourable rates with special promotions for new clients, often including very low initial interest on selected offers. As the service is fully digital, you can submit a Letocredit loan online application 24/7 from a phone or laptop, without visiting a branch.

Letocredit operates as an information and comparison site and clearly states that it is not itself a financial organisation and does not grant loans or microcredits directly. All loans are provided by independent South African lenders that are responsible for the credit agreements, interest rates and fees, while Letocredit simply helps you find, compare and access their offers online.

Customer support on the Letocredit platform is primarily digital: you can browse FAQs, use the help links, and then contact the chosen lender’s customer service for detailed questions about your specific loan. For a complete list of conditions, legal information and the most up to date offers, the official website letocredit.co.za should always be your reference point.

Apply for a Letocredit loan online in minutes and get matched with a quick offer today.

Pros of Letocredit ✅

- Fast and simple Letocredit loan online application with a fully digital process and decisions often made within minutes by partner lenders.

- Free service: Letocredit does not charge registration, comparison or broker fees, so you can compare and apply without extra platform costs.

- Special offers for new clients, such as very low or even 0.01% promo rates on selected loans, which help you avoid overpaying on your first borrowing.

- Low entry requirements, with some lenders willing to consider applicants with limited or no formal credit history, as long as income and affordability are reasonable.

- 24/7 online access, so you can apply for a Letocredit loan online at any time of day, useful for unexpected bills, medical expenses or urgent repairs.

Cons of Letocredit ⚠️

- Interest rates on some short term loans can be higher than bank personal loans, especially if you choose very short repayment periods or roll over debt.

- Letocredit itself cannot resolve disputes: all issues with interest, fees or collections must be handled with the specific lender that granted the loan.

- The exact loan amounts and rates depend on partner lenders and your profile, so the first Letocredit online loan you see may not always be the cheapest on the market.

- Promotional low rates are usually limited to new customers and can change over time, so conditions for repeat loans may be less favourable.

📊 Letocredit is one of many online loan options in South Africa, compare its sums, terms and rates with other lenders on Lafingo and find the best loan for your needs.

-

Info and review Century Borrow R1,700 for 30 days → repay ±R1,991.60Get a loan

-

Info and review PrimeLoans A salaried worker applies for R2,000 to cover car repairs. The money arrives within an hour, and repayment is scheduled on their next payday.Get a loan

-

Info and review Letocredit The minimum loan repayment period is 61 days and the maximum is 365 days. The minimum annual interest rate (CAT) is 0%, while the maximum is 36%. For example, for a loan of 1000 R with a repayment in 67 days, the costs will be 0 R and the total amount to be repaid will be 1000 R with a CAT of 0%. Interest rates depend on the lender you choose and will be determined based on your circumstances and credit history.Get a loan

-

Info and review Creditum A loan of R30,000 over 36 months at 27.5% APR (incl. fees) = monthly repayment ~R1,232.82Get a loan

What loans does Letocredit offer? 🧾

Letocredit offers access to multiple types of online loans in South Africa, mostly short term and small personal loans provided by partner lenders. The platform focuses on helping you find a Letocredit quick loan for emergencies, everyday cash flow gaps or small planned purchases, with simple eligibility requirements and fast decisions.

While Letocredit itself does not prescribe fixed maximum sums for each product, partner lenders typically provide:

- Short term and payday-style loans suitable for urgent expenses, such as car repairs, appliance replacement or unexpected medical bills.

- Small personal loans that can stretch over a few months, useful for school fees, minor home improvements or travel costs.

According to the general disclosure on letocredit.co.za, typical loans arranged through the platform have minimum repayment periods starting from 61 days and maximum terms up to 365 days. The minimum annual interest rate can be 0% on promotional offers, while the maximum indicated annual rate is around 36%, depending on the lender and your credit profile.

All Letocredit loans are paid out in South African rand directly to your bank card or bank account by the lender once the contract is approved. Applications, approval steps and loan management are performed online on the lender’s website or app, after you are redirected from Letocredit.

Find your best Letocredit loan offer today and compare several proposals before you decide.

How to apply for a Letocredit loan in South Africa 🧮

Applying for a Letocredit loan online in South Africa is quick and fully digital, designed so you can complete everything from your phone. The platform works as a starting point, guiding you to a lender’s loan application form online that matches your profile.

Here is the typical Letocredit loan online process in South Africa:

- Go to letocredit.co.za and choose your desired loan amount and term using the on page sliders.

- Complete the short Letocredit loan online application form with basic personal information and contact details, making sure you avoid typos.

- The system forwards your request to suitable lenders, where you fill out the lender’s own loan application form online, including employment and income details.

- Upload or provide access to supporting documents, such as your Smart ID Card, proof of income and recent bank statements if requested by the lender.

- The lender runs a credit and affordability assessment according to South African regulations and provides a decision, often within minutes.

If approved, money is transferred to your bank card or bank account, usually on the same day and often within 15–30 minutes after confirmation, depending on your bank.

Typical requirements for a Letocredit online personal loan or quick loan:

- You must be a South African resident, at least 18 years old, and usually not older than 70–75 years at the end of the loan term.

- You need a valid South African Smart ID Card or ID document for identity verification.

- You should have a stable source of income and a bank account where your salary is paid.

- You must provide accurate information; incorrect data can reduce your chances of approval or lead to rejection.

Letocredit and partner lenders may also request additional documentation for higher loan amounts, such as proof of residence or extra bank statements.

Contact details for Letocredit ☎️

Letocredit functions as an online information and comparison platform rather than a branch based lender, so contact is mostly through the website. Below are the general contact details based on public information.

- Address: The website is operated by Livornica AM LLC, Republic of Armenia; specific South African office details are not publicly listed and may change, so always check the official site.

- Working hours: The online service is available 24/7 for submitting a Letocredit loan online application, while partner lenders typically process applications during normal business hours and extended evening times.

- Email: Email contact is listed on the official Letocredit website and can be used for general platform questions.

- Phone: Phone contact for Letocredit is not prominently published; for loan specific questions, you should use the lender’s customer service number shown in your loan contract or on the lender’s website.

If you have questions about your specific Letocredit loan payment schedule, outstanding balance or reference number, it is best to contact the lender that approved your loan directly through their official channel.

Customer reviews of Letocredit loans 💬

User experiences on Letocredit are generally positive, particularly around speed, convenience and the lack of hidden platform fees. Many customers appreciate being able to get a loan online in a single place, without manually checking different lender websites.

Some users say the Letocredit quick loan process helped them cover urgent household repairs or medical bills within the same day, thanks to fast online approval. Others highlight the simple, clear web interface and the fact that no cards or SMS codes are required just to register and compare offers. However, a few borrowers mention that they expected more offers or lower rates and remind future users to check the final interest and fees with the lender before signing.

Overall, Letocredit loans online are perceived as a practical way to access multiple credit options from one platform, as long as you carefully review each lender’s agreement.

⚡ Letocredit online loan – quick access to small, short term loans in rand with transparent conditions and no platform fees, compare and get your loan today on Lafingo.

Why choose Letocredit in South Africa? 🌍

Letocredit stands out in the South African loan market by combining loan comparison, simple online tools and partner offers into one free service. This makes it suitable for residents who want to quickly compare short term loans without paying broker fees.

Key reasons to choose Letocredit online loans:

- Fast and fully digital application journey, from initial comparison to lender approval and payout.

- A broad range of short term and small personal loans, so you can choose a Letocredit online personal loan or quick loan that matches your needs rather than accepting the first offer.

- No commissions or hidden comparison charges from Letocredit itself; the service is financed through cooperation with lenders.

- Focus on accessible lending, where some partners are ready to consider applications even if your credit history is thin or imperfect.

Expert opinion about Letocredit in South Africa in 2026 🧠

Letocredit is most useful for South Africans who need a relatively small, short term loan and want to compare several offers quickly instead of visiting banks one by one. This includes people dealing with unexpected bills, minor car repairs, urgent travel or bridging cash between paydays.

Because Letocredit does not issue loans itself, the quality of your experience will depend on the lender you choose from the list of offers. For financially responsible users who carefully read each lender’s terms, calculate the real cost and repay on time, Letocredit can be a convenient gateway to fast online loans at reasonable rates. For borrowers already struggling with debt, it is important to treat Letocredit as a tool for solving short term problems, not as a long term solution.

Our conclusion about Letocredit in South Africa in 2026 ✅

Letocredit is a reliable, easy to use online loan comparison service for South Africans who want to access quick online loans without paying extra broker or platform fees. The combination of simple registration, 24/7 availability and special promotional rates for new clients makes it an attractive option for small, short term borrowing.

The best use cases for Letocredit include urgent but manageable expenses, such as appliance repairs, medical bills, school costs or travel tickets, where you need money fast and plan to repay within a few months. Benefits include fast approval, a 100% online process, and loan offers adapted to people with different credit profiles, including those with limited history. However, borrowers looking for large, long term loans or the lowest possible interest rates may still want to consider traditional banks and other comparison platforms as alternatives.

Used responsibly, Letocredit online loans can be a helpful financial tool rather than a burden, especially if you compare several offers on Lafingo, choose an affordable repayment plan and avoid multiple simultaneous loans.

Frequently Asked Questions (FAQs) about Letocredit 🔎

-

Does Letocredit give loans directly❓

-

Can I apply for a Letocredit loan online at any time❓

-

What are the typical Letocredit loan terms❓

-

What interest rates can I expect through Letocredit❓

-

What are the basic Letocredit loan online application requirements❓

-

Can I get a Letocredit online loan without a credit history❓

-

How long does it take to receive money from a Letocredit quick loan❓

-

How can I increase my chance of getting a Letocredit loan online❓

-

Can I have multiple Letocredit loans at the same time❓

-

How do I repay a Letocredit loan❓