Digido online loan review in the Philippines in 2026

Digido loans is a popular online lending platform in the Philippines offering loans amounting from PhP 1,000 to PhP 25,000. Previously operating under the name Robocash, Digido is a legitimate loan provider duly recognized by the Philippine Securities and Exchange Commission (SEC).

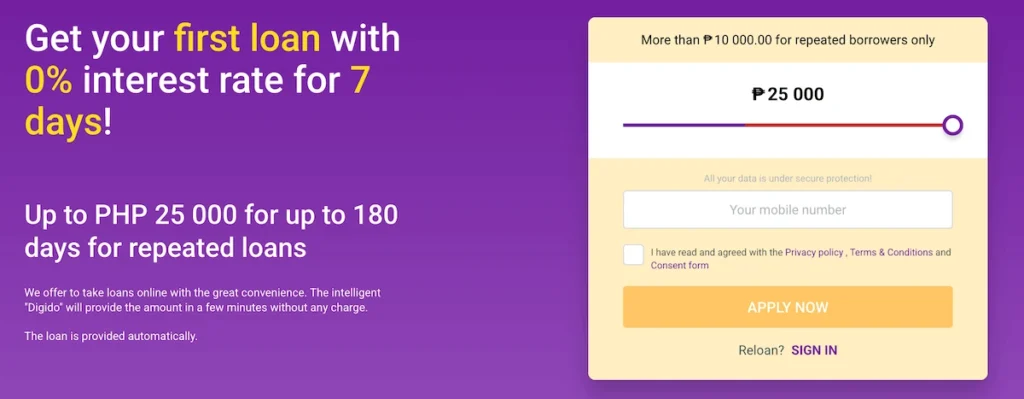

Online personal loan with fast approval. Loan amount from PhP 1,000 to PhP 25,000.

Get a loan!

Much like most popular lending companies these days, Digido loan online application process is fully digital. This means borrowers no longer have to go to physical outlets, and thus only need to apply and submit documents via the internet. Digido online loans also offer fast approval and disbursement of cash to borrowers.

Digido online personal loan operates under the SEC Certificate of Authority No. 1272 and registration number CS202003056.

Read other loan reviews on Lafingo.

Digido calculator

* Only for informational purposes

Who can apply for Digido loan online?

Those who meet the requirements below can apply for the Digido loan online:

- Must have a valid identification ID such as Voters ID, UMID, SSS, Passport, Driver’s License, or TIN

- Must be a Filipino citizen

- Must be 21 to 70 years of age

- Must have an active/working mobile number

The Digido loan online application process in 2026

Here’s a detailed guide on the Digido loan online process

- Step 1: Register for an account via the Digido online loan app or website.

- Step 2: Choose the loan amount you need and provide your phone or mobile number then click “Apply Now”.

- Step 3: Enter the confirmation code you will receive via SMS.

- Step 4: Complete the Digido loan application form online.

- Step 5: Choose your preferred way of receiving the loan amount and enter the necessary details. For example, if you chose to receive the funds via your bank, then enter your personal bank details.

- Step 6: Sign the Digido online contract.

- Step 7: Wait for the loan amount to be disbursed after signing the loan contract. Make sure to provide correct details on your chosen method of receiving the funds to avoid cancellation of the loan.

Loan application process

The Digido loan online application process and mechanics are quite straightforward.

- Loan amount – Borrowers can borrow from PhP 1,000 to PhP 25,000.

- Repayment period – Digido offers flexible payment terms of 3, 6, 9 to 12 months.

- Interest rates – Online loan Digido charges different interest rates depending on whether the borrower is a first-time or repeat borrower.

- First-time borrowers will enjoy zero percent interest rates for the first seven days of the loan.

- Repeat borrowers will be charged up to 1.5% interest rate per day.

- Collateral – Digido loans online do not require collateral.

- Repayment methods – Borrowers can repay their Digido loans either via QRPH, online banking, ATM banking, digital wallets, and over-the-counter payment.

Frequently Asked Questions (FAQs) about Digido 🔎

-

What if I can’t repay the Digido online personal loan I availed❓

-

How will I know if Digido quick loan approved my application❓

-

What if I accidentally provided incorrect bank details❓

Read customer reviews about Digido in 2026 ⭐

There are no reviews yet. Be the first one to write one.