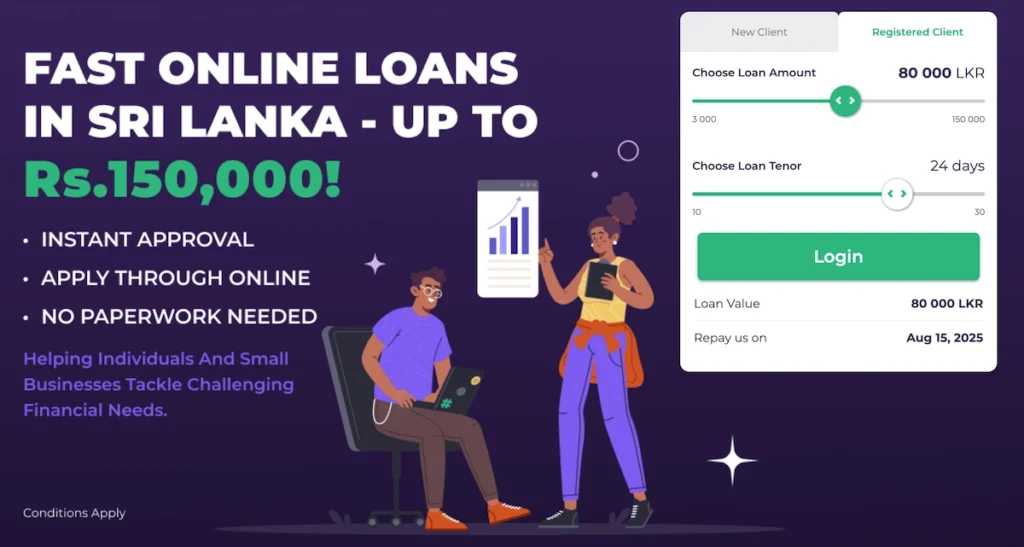

Monigo.lk is an online lending platform based in Sri Lanka, it offers quick and convenient financial solutions for those in need of urgent loan. Monigo provides loans for a medical emergency, short-term financial help, or any other urgent need. It’s a fully remote, reliable and easy process.

No paperwork needed, just apply for the loan and receive your money within 24 hours

Apply Now

Monigo pros and cons

✅Pros

- Instant loan approval – Loan approvals can be made within as little as 10 minutes during business hours.

- No paperwork needed – Only a valid national ID and selfie photo are required.

- Easy to use platform – Accessible via smartphone or computer, allowing users to complete the loan application within minutes.

- Platform security – Monigo prioritizes data protection and ensures a trustworthy experience.

❌Cons

- Short repayment period – The maximum term is limited to 30 days.

- Higher interest rates – Fast loans often have higher interest rates compared to long-term options.

About Monigo

Monigo is a user-friendly online loan platform created to meet the financial needs of individuals and small businesses in Sri Lanka. It operates under “SF Group (Private) Limited”, registered in Sri Lanka under company number PV 00221752. It is operating under parent company Sun Finance Group, which is a globally recognized financial service provider operating across Europe, Asia, and Africa. The company was established in 2017 and claims a legacy of innovation and excellence in fintech.

Basic Information

- Loan amount: Rs. 3,000 to Rs. 150,000

- Interest rate: Generally ranges from 24% to 35% per annum, first loan with 0%

- Repayment period: Up to 30 days

- Eligibility: Everyone aged 20–60 with a valid ID

- Processing time: Once approved, funds are typically disbursed within 24 hours

- Phone number: 117358358

- Email address: info@monigo.lk

- Address: 341/5, M & M Center, 1st Floor, Kotte Road, Rajagiriya, Sri Lanka

- Working hours: Monday to Friday, 8:30 AM – 5:30 PM

Requirements

- Age between 20-60

- Valid identification (NIC/Passport)

- Have a mobile phone number

- Active bank account

- Have a valid mobile phone number

🖋️How to apply for a Monigo loan

The Monigo loan application process is simplified into four steps:

- Visit Monigo.lk website

- Select the desired loan amount (Rs. 3,000 to Rs. 150,000) and repayment term (up to 30 days)

- Register/login at Monigo from your phone or computer

- Complete the application process

- Allow Monigo to make a decision, it should take from 10 minutes to 1 working day

- Receive your money, approved loans are transferred directly to your bank account.

Frequently Asked Questions (FAQ) – ❓

-

What is the interest rate and service fee❓

-

How long does the application review take❓

-

Can I get another loan if I already have one❓

-

What if I can’t repay the full loan amount❓

-

Can I repay the loan early❓

-

What should I do if my payment confirmation is delayed❓

Read client reviews for Monigo in 2025 ⭐

People also solwed her emergency problem

The loan process was super easy, and I received the funds within a few hours. Very satisfied with their service and transparency.

I’ve used Monigo twice now, and both times they were reliable. What I appreciate most is that there are no hidden fees, and everything is clearly explained before you confirm the loan.

Their website is very easy to use, and I was able to complete my application in under 10 minutes. The customer support team was also polite and helpful. Interest rates could be a bit lower though.