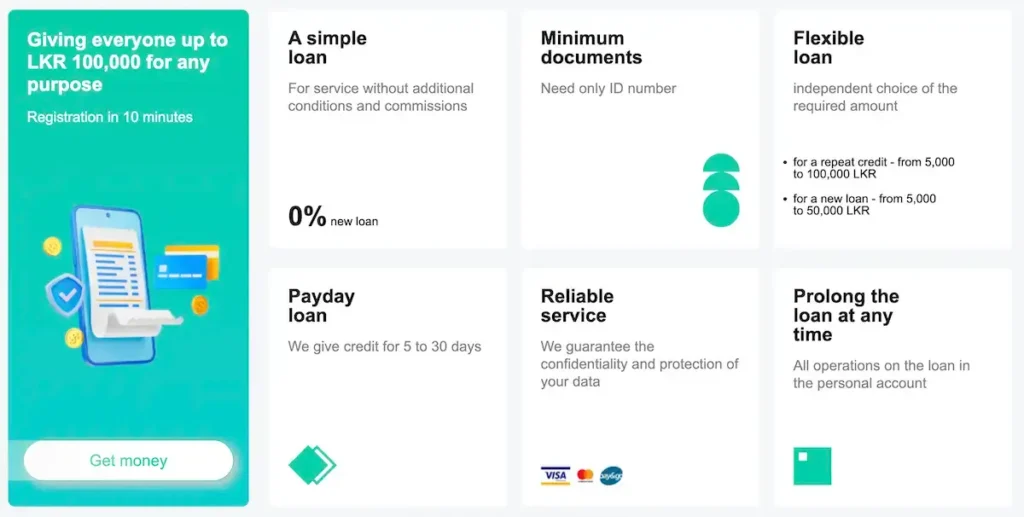

OnCredit loan provides advisory and financial services in Sri Lanka. Their mission is to make financial services accessible to all, regardless of location or situation. OnCredit provides a seamless and secure online platform. It allows customers to meet urgent financial needs quickly and efficiently. OnCredit is based in Sri Lanka and uses simple and reliable methods to provide financial services. They operate through a simple online business model to provide loan services to customers easily. Read more about Oncredit with Lafingo and get a quick loan in Sri Lanka!

Oncredit pros and cons in 2025

Pros ✅

- Simple loan terms with secure processes

- Fast loan approval, available 24/7

- Transparent fees with no hidden charges

- User-friendly and helpful customer support

Disadvantages ❌

- Limited loan amount for new customers

- Late payment penalties may apply if repayment is not made on time

OnCredit – cash loan online in Sri Lanka. Fast online financial loans for you!

Get a loan now

About OnCredit

OnCredit Private Limited operates throughout Sri Lanka, providing financial services to all citizens island-wide. The company is committed to convenience, security and transparency, striving to provide innovative solutions to the financial needs of its customers. More information is below:

- Customer Service Number: +94117811555 (8:30 AM – 5:30 PM, Monday to Sunday)

- WhatsApp: 0704706670

- Email Address: info@oncredit.lk

- Website: www.oncredit.lk

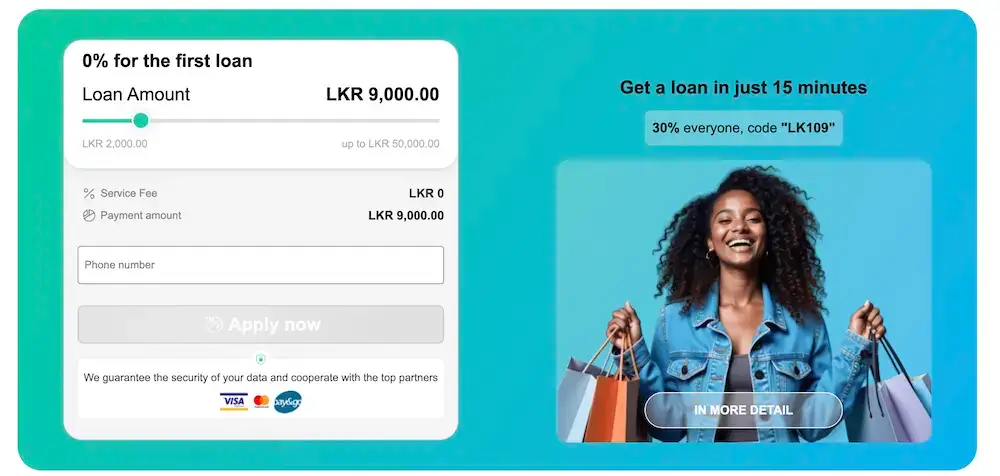

Oncredit loans information in දෙසැම්බර් 2025

- First Loan Amount: LKR 2,000 to LKR 50,000

- Interest Rates: 0% for the first loan; Up to 16% for subsequent loans

- Repayment period: Flexible terms available

- First loan offer: 0% interest for first-time users

- Service fee: No fee for the first loan

Eligibility requirements

- Must be a Sri Lankan citizen

- Must be between 20 and 55 years of age

- Must have a stable source of income

- Must have a National Identity Card (read about NIC here)

How to apply for a loan?

To apply for a loan with OnCredit, follow these steps:

- Log in to the website at www.oncredit.lk or via the mobile app.

- Select the required loan amount.

- Enter personal information and upload your National Identity Card (front and back).

- Upload a selfie and provide bank details.

- Wait for approval and receive a verification call.

Frequently Asked Questions (FAQ) about Oncredit❓

-

How do I qualify for a loan with Oncredit❓

-

Can I get more amount than my first loan amount❓

-

How long does it take to receive money from the Oncredit loan application❓

-

What happens if I am late in repaying my loan❓

-

Can I repay my loan early❓

Read OnCredit customer reviews in 2025 ⭐

Good service, but it would be more beneficial if I could get a larger loan amount initially.

Easy to apply and the process was smooth. I didn’t even have to leave my house!

Customer service was helpful and answered all my questions. Great experience overall.