Credify is a popular online loan provider in Sri Lanka, known for offering fast and easy financial solutions. The platform is designed for people who need a quick access to money without any paper work and complicated processes like in traditional banks. Credify cash loan services are designed to be easily accessible and user-friendly to cover unexpected expenses, urgent medical bills, or bridge a short-term financial gap. The company’s commitment to transparency, speed, and efficiency has made Credify loans a top choice for Sri Lankans seeking quick and reliable financial assistance.

Credify pros and cons

✅Pros

- 📝 Quick and simple online application process

- ⚡ Fast loan approval and disbursement, often within 24 hours

- 🔍 No hidden fees. All terms and conditions are clearly stated

- 🙌 Accessible to those with limited or no credit history

- 🔄 Flexible repayment options to suit different financial situations

❌Cons

- 📈 Higher interest rates compared to traditional bank loans

- 💸 Limited maximum loan amounts that may not be sufficient for large financial needs

- ⏳ Short repayment periods that may be challenging for some borrowers

About Credify

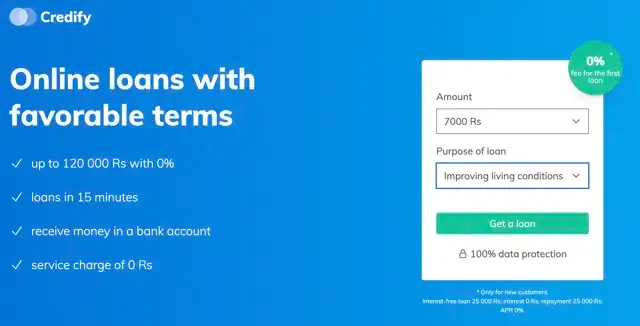

Colombo-based Credify loan platform serves customers seeking the quickest loans without the hassle of traditional banks. Customer access through the Credify website includes clear terms, support, and flexible repayment plans tailored to different income levels. Credify loans has quickly gained popularity as a reliable and convenient financial service provider for Sri Lankans in need of immediate funds.

Basic Information

- Loan Amount: Up to Rs. 200 000

- Time Taken: 15 minutes (Approved loans are usually provided within 24 hours, which is ideal for urgent situations.)

- Interest Rate: Usually ranges from 25% to 36% per annum, depending on the loan amount and repayment period.

- Repayment Period: From 1 to 12 months.

- Company Name: Schaefer LLC

- Address: 9 Liela Street, Saldus, Latvia LV-3801

- Email Address: info@credify.lk

- Hours: 24 hours a day, 7 days a week.

Requirements

- Sri Lankan citizen

- Age 21 – 65

- A valid ID

- A stable source of income

🖋️How to apply for a Credify loan

Visit the Credify website: Go to https://www.credify.lk/ and create an account by providing basic personal information and filling out the online loan application form. Upload the required documents. Wait for approval.

Requirements:

- Must be a Sri Lankan citizen with a valid ID.

- Must provide proof of income such as payslips or bank statements.

- An active bank account is required for disbursement of funds.

Frequently Asked Questions (FAQ) -❓

-

Can I get multiple loans at once❓

-

Where can I repay my loan❓

-

Is there a limit to the amount I can borrow❓

Read client reviews for Credify in 2026 ⭐

I applied for a loan with Credify when I needed money urgently for medical expenses. The online process was smooth and only took about 10 minutes. The money was in my account the same day. Highly recommended!

I got what I needed, but it might not be enough for bigger expenses. Still, a good option for small emergencies.

I had never taken a loan before, and my credit history was limited. Credify didn’t require much paperwork and approved my loan within minutes. I appreciated the clear terms and the easy repayment system.

Credify helped me cover some unexpected car repair costs. Interest rates are a bit high, but that’s expected for quick loans. Still, very convenient if you’re in a pinch.