Crezu loan review in Sri Lanka in March 2026

This page provides a full review of Crezu’s loan services in Sri Lanka for 2026. You can compare various loan offers through Lafingo to find the best deal. Lafingo simplifies your loan comparison process, offering transparency, convenience, and quick access to the most suitable options, ensuring you make an informed financial decision.

💰 Apply for a Crezu loan now – request from about Rs. 200 up to Rs. 150,000 and get a fast decision online in just a few minutes!

Get fast online loans online instantly and quickly at Crezu financial platform – applications are approved within 5 minutes ✅

Request your loan

Crezu is an excellent platform for Sri Lankans seeking quick, transparent, and flexible online loans. It provides instant comparisons across multiple licensed lenders, ensuring you get the best deal without hassle. Whether you need emergency cash, want to consolidate debt, or cover short-term expenses, Crezu simplifies the process and offers trustworthy options. Always compare your options on Lafingo to find the most favorable terms tailored to your financial situation.

What is Crezu?

Crezu is a fast, online loan matching platform operating in Sri Lanka. It is not a direct lender but a service that compares multiple licensed financial institutions, connecting borrowers with the best loan offers without the need to apply separately to each lender. Crezu operates under the umbrella of Fininity Ltd, and the service is completely free with no hidden fees or charges. It specializes in helping Sri Lankans access personal loans for various purposes, from emergencies to consolidations and personal expenses.

Many users highlight Crezu’s quick approval process, usually within minutes, and the straightforward application process. The platform supports secure data handling in line with Sri Lankan financial regulations, ensuring privacy and safety for all users.

Benefits of choosing Crezu include ✅

- Instant approval outlooks in minutes

- Access to multiple loan providers with a single application

- No service fees or hidden charges

- Flexible loan purposes such as debt consolidation, medical expenses, travel, or home repairs

- Available online 24/7, with support for the modern Sri Lankan user

Limitations include ❌

- Crezu is not a direct lender; approval depends on partnered lenders

- Interest rates vary widely and depend on the lending institution

- Shorter repayment periods compared to traditional bank loans

🔎 Compare Crezu with other Sri Lankan loan providers on Lafingo and find the online loan with the best sums, terms and rates for you!

-

Info and review Soscredit Calculation example (representative example): Loan of Rs 50 000 for 6 months, monthly payment Rs 8 948, total amount Rs 53 688, annual percentage rate APR 15%. The maximum APR is 365%.Get a loan

-

Info and review Soso *Calculation example (representative example): Loan of Rs 50 000 for 6 months, monthly payment Rs 8 948, total amount Rs 53 688, annual percentage rate APR 15%.Get a loan

-

Info and review CashX A representative example: You apply for RS. 10,000.00 and choose comfortable repayment over 10 days, your payment will be only RS. 12,200.00 per 10 days, so your total cost of the loan will be RS. 12,200.00Get a loan

-

Info and review Oncredit Minimum APR: 1% (First loan with 0% interest and service fee), Minimum period: 90 days, Maximum period: 180 daysGet a loan

How does Crezu work in Sri Lanka?

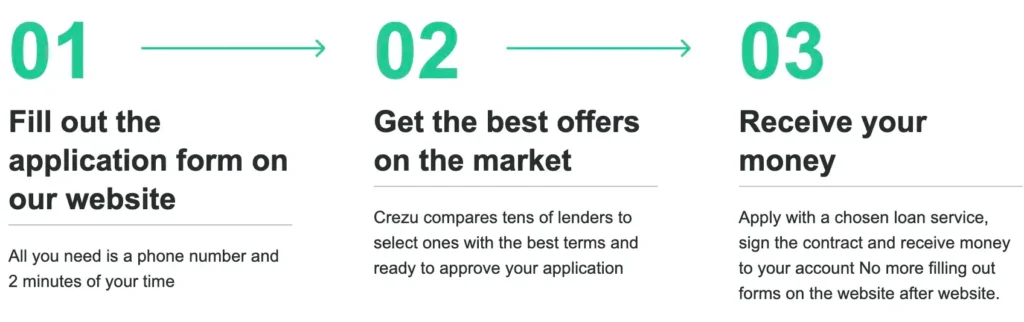

- Fill out a brief online application on crezu.lk, providing basic info such as ID, phone number, and loan amount.

- Crezu compares offers from dozens of Sri Lankan lenders, presenting the best terms available for your profile.

- Choose an offer that suits your needs and complete the formal agreement directly with the lender.

- The approved amount is typically transferred to your bank account within a few minutes to a few hours, depending on the lender.

Crezu simplifies the process, requiring only your ID and bank account details, and making it easy to find and secure quick loans for immediate needs, whether for personal expenses, travel, or other purposes.

Why choose Crezu in Sri Lanka?

Crezu is ideal if you need a reliable, transparent, and quick solution for small-to-medium loans. It supports multiple lenders, allowing you to compare rates and terms easily without multiple applications. The platform requires minimal documentation, mainly your ID and bank details, and provides approvals often within minutes. This makes it perfect for urgent situations such as medical emergencies, bill payments, or travel expenses.

The service’s flexibility, coupled with the absence of hidden fees and the ability to compare multiple offers instantly, makes Crezu one of the most convenient loan comparison platforms in Sri Lanka today.

Our conclusion about Crezu in Sri Lanka in 2026

Crezu is a trustworthy and fast online loan comparison tool tailored for Sri Lankan borrowers in 2026. It enables quick access to multiple flexible loan options, matching you with the best rates in minutes. The service is especially suited for borrowers who seek transparency, ease of use, and fast approvals, making it a top choice for short-term financial needs. While it is not a direct loan provider, its extensive network of verified lenders ensures you get competitive offers. For larger or long-term loans, traditional banks may still be preferable, but for emergency cash and small personal loans, Crezu is highly recommended.

⚡ Discover Crezu personal loans – quick online application, no service fee from Crezu and flexible short-term repayment. Compare and get a loan on Lafingo today!

Frequently Asked Questions (FAQ) about Binixo 🔎

-

Is Crezu a bank or lender❓

-

Does Crezu charge any fees for submitting a request❓

-

What information do I need to provide to apply online❓

-

Can I still get a loan if I have a bad credit history❓

-

What amounts and terms can I get❓

-

What are the interest rates❓

-

How fast will I receive the money❓

-

Is my personal information safe with Crezu❓

-

Do I need to apply on other websites as well❓

-

Where can I read more about Crezu’s policies❓

Read client reviews for Crezu in 2026 ⭐

There are no reviews yet. Be the first one to write one.