Soso.lk is an online lending platform that simplifies the process of getting a loan and applying for a loan in Sri Lanka. With SOSO, you can easily access loan offers from multiple lenders without leaving your home. SOSO is a platform designed for those looking for an online loan that is fast, reliable and transparent.

Read more about Soso with Lafingo and get a quick loan in Sri Lanka!

Soso pros and cons in 2026

Pros ✅

- Easy to use – Applying for a SOSO loan is completely online, and can be done anywhere, anytime.

- No collateral required – You do not need a guarantor or any kind of collateral to get a SOSO cash loan.

- Quick loan disbursal – Your loan is disbursed within 15 minutes to a maximum of 1 working day. SOSO quick loans are ideal for urgent needs.

- Transparent terms – SOSO loan terms are very clear and there are no hidden fees.

Disadvantages ❌

- High Annual Percentage Rate (APR) – Interest rates can be high, with a maximum APR of 365%.

- Late fees – If your payment is late, a daily late fee will be charged.

- Loan transfer – Long-term delays may result in the loan being transferred to a third party.

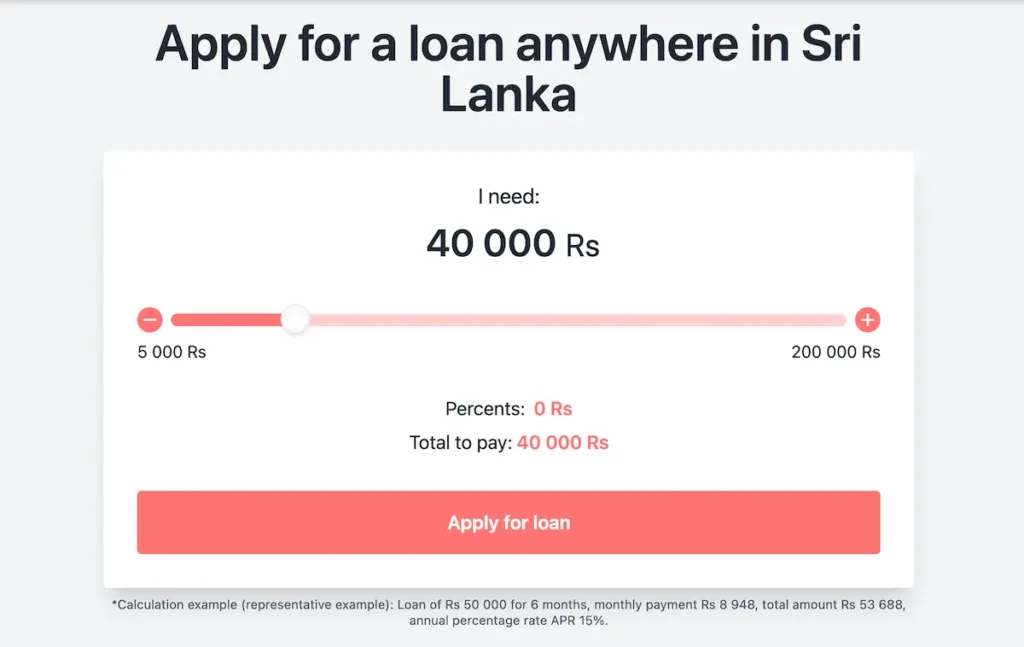

SOSO.lk allows to apply for a loan from anywhere in Sri Lanka!

Get a loan now

About Soso loan

SOSO.lk was established to simplify the loan application process for Sri Lankans, enabling them to access loan facilities without having to travel to banks. It serves as an intermediary between users and Soso peer lenders.

SOSO.lk does not issue loans directly, but facilitates access to several SOSO online loan offers, simplifying comparison and decision-making.

Soso loans information in 2026

- Loan terms: range from 3 to 12 months.

- Loan amount: Borrowers can request money starting from Rs. 5,000. to Rs 200,000

- Annual Percentage Rate (APR): APR varies from 15% to a maximum of 365%.

- Repayment Options: Repayments can be made through SOSO online banking, at bank branches, or through mobile apps like iPay.

How to apply for a loan?

- Fill in the Application – Select the amount you need, enter your email, and submit the SOSO loan application online.

- Accept the Application – Compare loan offers from different SOSO lenders in the email.

- Sign and Get Money – Choose the best offer, sign the agreement, and receive the money in your bank account.

Requirements

Requirements to be met to get a loan:

- You must be at least 20 years old

- You must be a Sri Lankan citizen

- You must have a valid National Identity Card

- You must have a Bank Account

- You must have a valid Email Address

Frequently Asked Questions (FAQ) about SOSO❓

-

What is SOSO.lk❓

-

Do I need collateral❓

-

How quickly can I get a loan❓

-

How do I repay the loan❓

Read SOSO customer reviews in 2026 ⭐

Very happy with the SOSO loan application process. It is simple and fast, but interest rate could be lower.

I love how user-friendly the SOSO app is, and the loan terms are clear!

Fast and reliable

Thank you! I needed money urgently and you helped me easily. It was a pleasure using the service