A briefer on Soscredit loan online

Soscredit online loan offers Filipinos a fast and seamless way of getting micro-loans. Borrowers no longer have to present multiple documents or wait for days to get the loaned money as Soscredit, on average, approves the loan within 15 minutes from submission of the Soscredit loan application form online.

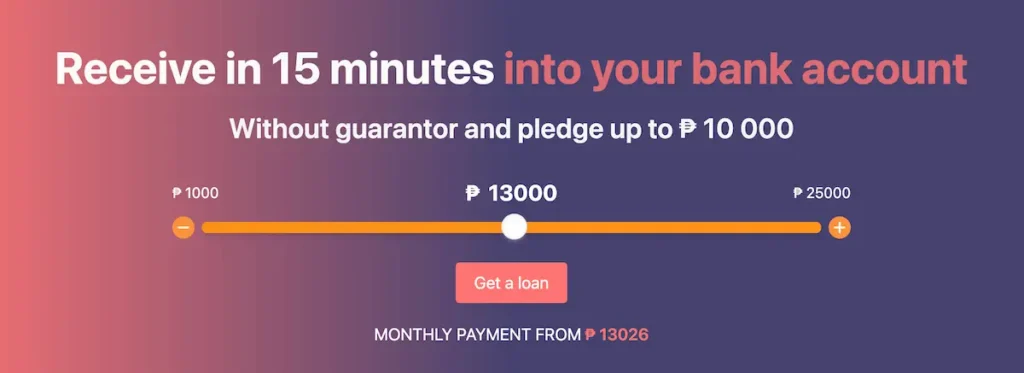

Soscredit – receive a loan within 15 minutes to your bank account. Online quick loans form PhP 1,000 to PhP 25,000

Get a loan!

Soscredit online loan is owned and operated by Online Media LLC, a firm based in Latvia. It also operates in other countries European countries like Mexico, Spain, and Poland, and Asia like Vietnam.

More loan reviews can be found here, on Lafingo.

Soscredit calculator

* Only for informational purposes

How to apply for online Soscredit loan?

- Step 1: Select the amount of money you need to loan.

- Step 2: Fill out the loan application form online. Make sure to double-check the information provided to avoid any inconvenience in the loan processing.

- Step 3: Wait for Soscredit Loans to acknowledge your loan application and provide feedback.

- Step 4: Wait for the money to be credited to your nominated bank account. Soscredit, on average, takes around 15 minutes to process, approve, and disburse the loan to the borrower’s bank.

What are the Soscredit micro loans requirements in 2026?

Below are the requirements to avail of the Soscredit Philippines online loan.

- Be 20 to 65 years of age

- A legal resident of the Philippines

- Must have an active mobile phone number

- Must have a valid email address

- Must have an active bank account in their name

- Must have proof of income

- Must have valid, government-issued identification card such as UMID, SSS, Passport, Driver’s License, Voters ID, or TIN.

Online loan Soscredit does not require collateral or guarantors. Neither does it call the borrower’s employers to conduct a background check.

Soscredit online loan guidelines

- Loan amount – Customers can borrow from PhP 1,000 to PhP 25,000. Soscredit, however, may choose to approve a loan lower than the requested amount.

- Interest rates – Soscredit online loans may charge interest of 2.17% per day, with a maximum annual percentage rate of 180%. For first-time borrowers, the first 62 days of the loan are free of charge for amounts up to PhP 10,000.

- Cash disbursement method – The loaned money will be deposited into the personal bank account of the borrower. You may not receive your borrowed funds should you provide incorrect bank account details.

- Repayment period – Borrowers can repay their Soscredit online personal loan within 90 days to one year.

- Repayment channels – Borrowers can repay their loans at designated banks.

- Collateral – Soscredit online loans do not require collateral, nor a guarantor. Neither does the lending platform conduct employment checks. Proof of income will suffice.

Frequently Asked Questions (FAQs) about Soscredit 🔎

-

Where can I find the details of my loan❓

-

Is there a customer service team I can get in touch with❓

-

Is my information safe with the Soscredit Philippines online loan❓

Read customer reviews about Soscredit in 2026 ⭐

Soscredit definitely lives up to its promise of fast cash. The application took just a few minutes, and I had the money the next day. My only issue was that the repayment period felt a bit short, but it’s still a solid option when you’re in a pinch.

I was pleasantly surprised by how easy it was to get a loan from Soscredit. The only minor downside was the slightly higher interest compared to some other lenders, but the fast processing time made up for it. Overall, a reliable option for quick cash.

Honestly, I didn’t expect the process to be this easy. Soscredit helped me cover unexpected car repairs without any hassle. I appreciated the clear terms and reasonable interest rates. Highly recommended for anyone who needs a quick and reliable loan service.

I needed some extra cash for emergency medical expenses, and Soscredit was a lifesaver! The application process was incredibly fast and straightforward. I got approved within minutes, and the funds were in my account the same day. I highly recommend it to anyone in need of quick and reliable financial assistance!