An overview of Zaimoo online loan

Zaimoo online loan is a platform offering intermediary services so Filipinos can easily find the best online loans according to their needs and preferences. Zaimoo online personal loan works with the best Philippine-based financial institutions to enable Filipinos to get the cash they need almost as soon as they need it.

Loans in Zaimoo are easily accessible. A borrower only needs to fill out a single form and Zaimoo loan online will provide its recommendations while partner financial loan providers can credit the money to the borrower’s bank account in a few minutes. There’s no need to go to a physical outlet or sign multiple documents. Loans in Zaimoo are all digital.

Zaimoo quick loan is owned and operated by Densure LLC, a firm based in Armenia.

Read other loan reviews on Lafingo.

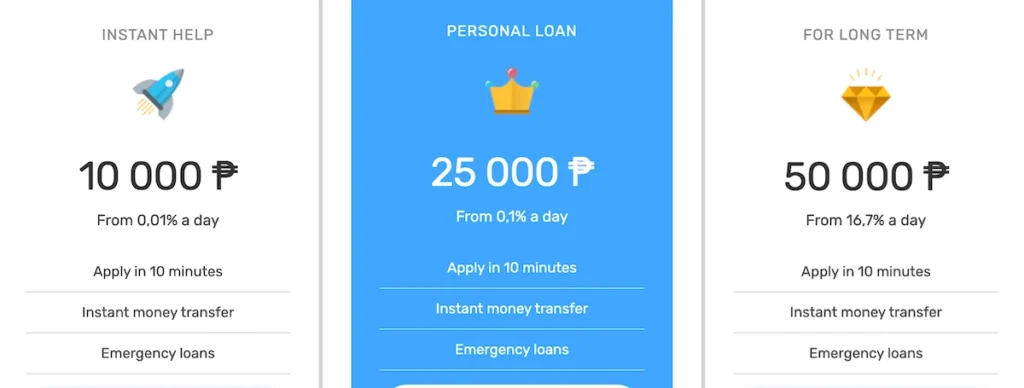

Multi-purpose online loans just in 10 minutes. Loan amount from PhP 500 to PhP 50,000.

Get a loan!

Personal loan online application process

Here’s how you can apply for a multi-purpose loan in Zaimoo:

Step 1: Choose the amount you wish to borrow. Keep in mind that a lower loan amount will have a higher chance of getting approved.

Step 2: Fill out the Zaimoo loan application form online to register for its service. Do not lie or put any false information during the registration process as your loan may be denied.

Plus, Zaimoo loans online may collect the following information from borrowers:

- Last name and first name

- Phone number

- Date of birth

- Physical address

- Email address

- Income information

- Bank account details

- IP address

- Other identifying information

- Website usage data

Step 3: Wait for the results of the Zaimoo loan app and website analysis. You will be provided with the best loan offers according to your preferred loan type, repayment period, loan amount, and other information you have provided.

Step 4: Choose from the loan offers after a careful review of all of them. Take the time to read the terms and conditions before making your selection.

Step 5: Wait for the approval of the loans in Zamoo. This can take around 10 minutes.

Step 6: Wait for the loan amount to show up in your designated disbursement method such as a digital wallet or bank account.

Zaimoo online loan mechanics

Loan amount – The loan amount ranges from PhP 500 to PhP 50,000.

Interest rates – The lending platform partners of Zaimoo will vary in their interest rates. The minimum is 11.9% per annum while the maximum is 365% per annum.

- For amounts up to PhP 10,00, the interest rate is 0.01% per day.

- For amounts up to PhP 10,000 to PhP 25,000 the interest rate is 0.1% per day.

Cash disbursement method – Zaimoo multipurpose loan online loan may disbursed either via credit cards such as Visa or Mastercard, e-wallets, or a bank deposit.

Repayment period – Zaimoo online loans may be repaid anywhere from 61 days to 60 months.

Collateral – There is no collateral needed to avail of via Zaimoo.

Frequently Asked Questions (FAQ)❓

-

Is there a way to contact Zaimoo loans customer service?

-

What is the maximum interest rate I can expect from loans in Zaimoo?

-

What is the maximum amount I can loan from Zaimoo online loan?