Creditum loan review in South Africa (2026) 🇿🇦

Looking for flexible personal loans in South Africa? Creditum offers a quick and transparent way to compare multiple loan offers from trusted lenders. With loans ranging from R500 to R350,000 and repayment terms of up to 72 months, Creditum is designed to help South Africans find the best deal without stress. Let’s dive deeper into how this platform works in 2026.

Compare Creditum personal loans online

💰 Apply for a Creditum loan today – borrow from R500 up to R350,000 with terms up to 72 months!

Apply now

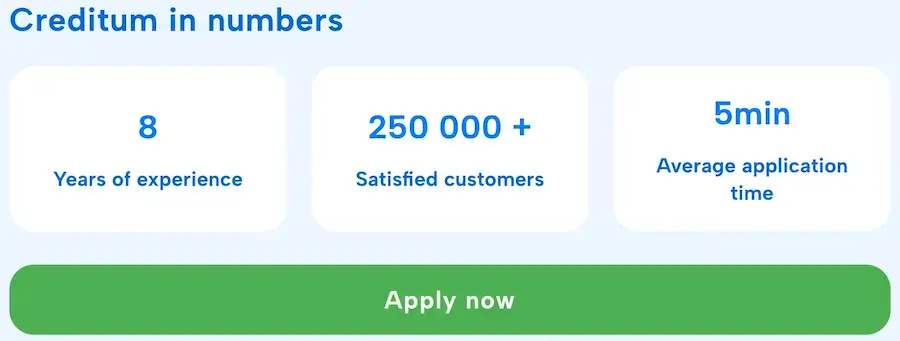

What is Creditum? 💡

Creditum is a South African loan comparison platform, not a direct lender. By filling out a short online form, you can instantly see offers from various NCR-certified lenders, compare terms, and choose the best fit. This saves time, avoids unnecessary paperwork, and ensures full transparency in the loan process.

⚠️ Important Notice: Be aware of scammers. Creditum applications are ONLY processed through the official website creditum.co.za. You will never be asked for your personal details via SMS or messaging apps.

Creditum loan details in South Africa (2026) 📊

- Loan amounts: R500 – R350,000

- Loan terms: 12 – 72 months

- Interest rates: 15% – 60% APR depending on credit profile and lender

- Fees: Initiation and service fees may apply, always disclosed upfront

- Approval time: Funds can be transferred within 24 hours once approved

Eligibility criteria for Creditum loans in 2026

While Creditum doesn’t set its own requirements, most partner lenders in South Africa ask for:

- South African citizenship or permanent residency

- Age 18 years or older

- A valid South African ID

- A bank account with internet banking access

- Proof of regular income (payslips or bank statements)

How to Apply with Creditum in South Africa?

The process is simple and fully online:

- Go to creditum.co.za and complete the short form.

- Provide details like employment, income, and banking information.

- Instantly compare offers from multiple lenders.

- Choose the loan that suits your needs.

- Finalize the application on the lender’s official page.

- Get funds transferred – often within 24 hours.

Creditum loans pros and cons

Pros 👍

- 100% online process with quick results

- Wide loan range (small emergency loans or large personal loans)

- Free comparison service, no hidden fees

- Doesn’t affect your credit score when comparing

Cons 👎

- Creditum is not a lender, only a broker

- High interest rates possible for poor credit applicants

- Final approval depends on the chosen lender, not Creditum

Customer reviews of Creditum in 2026 🗣️

- Positive: Many South Africans value Creditum for its speed, transparency, and ease of use.

- Negative: Some users were frustrated when pre-approved offers did not lead to final approval.

- Average rating: ~3.2/5 on independent review sites.

🔍 Compare Creditum offers and more on Lafingo – check reviews, ratings, and find the best personal loan in South Africa!

Expert opinion and responsible borrowing tips

Creditum is a useful tool if you want to compare personal loans quickly and safely in South Africa. Instead of visiting multiple lenders, the platform does the heavy lifting for you.

💡 Responsible borrowing tip: Always borrow only what you need and ensure you can manage the monthly installments comfortably. Avoid missing payments, as this may hurt your credit score and lead to penalties.

✅ Verdict: If you’re looking for an easy way to explore your loan options in 2026, Creditum is worth considering.

Frequently asked questions (FAQs) about Creditum❓

-

Is Creditum a lender❓

-

How quickly can I get a loan❓

-

Does using Creditum affect my credit score❓

-

How much can I borrow❓

-

What documents are required❓

-

Is Creditum free to use❓

-

Can I be rejected after seeing offers❓

-

Is Creditum safe❓